On this article we’re going to estimate the intrinsic worth of Rovio Leisure Oyj (HEL:ROVIO) by taking the anticipated future money flows and discounting them to at the moment’s worth. Our evaluation will make use of the Discounted Money Circulate (DCF) mannequin. Do not get delay by the jargon, the mathematics behind it’s truly fairly easy.

We typically consider that an organization’s worth is the current worth of all the money it would generate sooner or later. Nevertheless, a DCF is only one valuation metric amongst many, and it’s not with out flaws. For individuals who are eager learners of fairness evaluation, the Simply Wall St analysis model here could also be one thing of curiosity to you.

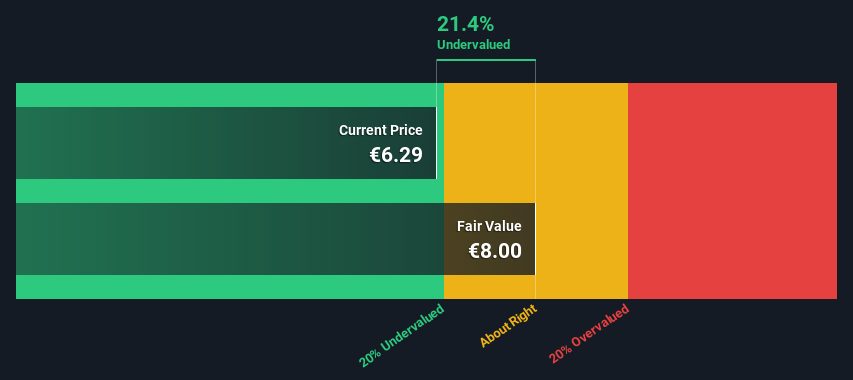

Our evaluation signifies that ROVIO is potentially undervalued!

The Calculation

We’re utilizing the 2-stage progress mannequin, which merely means we absorb account two levels of firm’s progress. Within the preliminary interval the corporate could have a better progress charge and the second stage is normally assumed to have a steady progress charge. To start with, now we have to get estimates of the subsequent ten years of money flows. The place doable we use analyst estimates, however when these aren’t out there we extrapolate the earlier free money stream (FCF) from the final estimate or reported worth. We assume corporations with shrinking free money stream will sluggish their charge of shrinkage, and that corporations with rising free money stream will see their progress charge sluggish, over this era. We do that to mirror that progress tends to sluggish extra within the early years than it does in later years.

Typically we assume {that a} greenback at the moment is extra beneficial than a greenback sooner or later, so we low cost the worth of those future money flows to their estimated worth in at the moment’s {dollars}:

10-year free money stream (FCF) forecast

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | |

| Levered FCF (€, Tens of millions) | €43.3m | €42.0m | €36.0m | €34.5m | €33.6m | €33.0m | €32.6m | €32.4m | €32.2m | €32.2m |

| Development Charge Estimate Supply | Analyst x6 | Analyst x4 | Analyst x1 | Analyst x1 | Est @ -2.66% | Est @ -1.78% | Est @ -1.16% | Est @ -0.73% | Est @ -0.43% | Est @ -0.21% |

| Current Worth (€, Tens of millions) Discounted @ 5.6% | €40.9 | €37.6 | €30.5 | €27.7 | €25.5 | €23.8 | €22.2 | €20.9 | €19.7 | €18.6 |

(“Est” = FCF progress charge estimated by Merely Wall St)

Current Worth of 10-year Money Circulate (PVCF) = €267m

We now must calculate the Terminal Worth, which accounts for all the longer term money flows after this ten yr interval. For a variety of causes a really conservative progress charge is used that can’t exceed that of a rustic’s GDP progress. On this case now we have used the 5-year common of the 10-year authorities bond yield (0.3%) to estimate future progress. In the identical means as with the 10-year ‘progress’ interval, we low cost future money flows to at the moment’s worth, utilizing a price of fairness of 5.6%.

Terminal Worth (TV)= FCF2032 × (1 + g) ÷ (r – g) = €32m× (1 + 0.3%) ÷ (5.6%– 0.3%) = €603m

Current Worth of Terminal Worth (PVTV)= TV / (1 + r)10= €603m÷ ( 1 + 5.6%)10= €349m

The entire worth, or fairness worth, is then the sum of the current worth of the longer term money flows, which on this case is €616m. The final step is to then divide the fairness worth by the variety of shares excellent. In comparison with the present share value of €6.3, the corporate seems a contact undervalued at a 21% low cost to the place the inventory value trades at present. Keep in mind although, that that is simply an approximate valuation, and like every advanced system – rubbish in, rubbish out.

The Assumptions

We might level out that an important inputs to a reduced money stream are the low cost charge and naturally the precise money flows. You do not have to agree with these inputs, I like to recommend redoing the calculations your self and enjoying with them. The DCF additionally doesn’t think about the doable cyclicality of an trade, or an organization’s future capital necessities, so it doesn’t give a full image of an organization’s potential efficiency. Provided that we’re taking a look at Rovio Leisure Oyj as potential shareholders, the price of fairness is used because the low cost charge, fairly than the price of capital (or weighted common value of capital, WACC) which accounts for debt. On this calculation we have used 5.6%, which is predicated on a levered beta of 0.955. Beta is a measure of a inventory’s volatility, in comparison with the market as an entire. We get our beta from the trade common beta of worldwide comparable corporations, with an imposed restrict between 0.8 and a pair of.0, which is an affordable vary for a steady enterprise.

SWOT Evaluation for Rovio Leisure Oyj

- Debt isn’t considered as a threat.

- Dividends are coated by earnings and money flows.

- Earnings progress over the previous yr underperformed the Leisure trade.

- Dividend is low in comparison with the highest 25% of dividend payers within the Leisure market.

- Shareholders have been diluted up to now yr.

- Annual earnings are forecast to develop quicker than the Finnish market.

- Buying and selling beneath our estimate of truthful worth by greater than 20%.

- Annual income is forecast to develop slower than the Finnish market.

Subsequent Steps:

While necessary, the DCF calculation should not be the one metric you take a look at when researching an organization. It isn’t doable to acquire a foolproof valuation with a DCF mannequin. As a substitute one of the best use for a DCF mannequin is to check sure assumptions and theories to see if they’d result in the corporate being undervalued or overvalued. For instance, adjustments within the firm’s value of fairness or the chance free charge can considerably influence the valuation. Why is the intrinsic worth greater than the present share value? For Rovio Leisure Oyj, we have compiled three additional components you need to take a look at:

- Dangers: We really feel that you need to assess the 1 warning sign for Rovio Entertainment Oyj we have flagged earlier than investing within the firm.

- Future Earnings: How does ROVIO’s progress charge evaluate to its friends and the broader market? Dig deeper into the analyst consensus quantity for the upcoming years by interacting with our free analyst growth expectation chart.

- Different Excessive High quality Options: Do you want a very good all-rounder? Discover our interactive list of high quality stocks to get an thought of what else is on the market chances are you’ll be lacking!

PS. The Merely Wall St app conducts a reduced money stream valuation for each inventory on the HLSE every single day. If you wish to discover the calculation for different shares simply search here.

Valuation is advanced, however we’re serving to make it easy.

Discover out whether or not Rovio Leisure Oyj is probably over or undervalued by trying out our complete evaluation, which incorporates truthful worth estimates, dangers and warnings, dividends, insider transactions and monetary well being.

Have suggestions on this text? Involved in regards to the content material? Get in touch with us immediately. Alternatively, e-mail editorial-team (at) simplywallst.com.

This text by Merely Wall St is normal in nature. We offer commentary primarily based on historic knowledge and analyst forecasts solely utilizing an unbiased methodology and our articles aren’t meant to be monetary recommendation. It doesn’t represent a suggestion to purchase or promote any inventory, and doesn’t take account of your aims, or your monetary state of affairs. We purpose to deliver you long-term centered evaluation pushed by basic knowledge. Observe that our evaluation could not issue within the newest price-sensitive firm bulletins or qualitative materials. Merely Wall St has no place in any shares talked about.

Source link